Navigating the changing landscape in the global SPC and LVT flooring market can feel overwhelming, right? Missing key shifts here could mean missing big chances or facing unexpected problems. I believe understanding these global trends is important for any international distributor who wants to grow.

International distributors must closely watch global SPC and LVT flooring market trends. These include strong growth, more construction activities worldwide, key product innovations, a growing need for sustainability, and changing trade dynamics and competition.

Looking at today’s global market, several things are shaping the SPC and LVT flooring industry. These things directly affect how you, as a distributor, buy and sell products around the world.

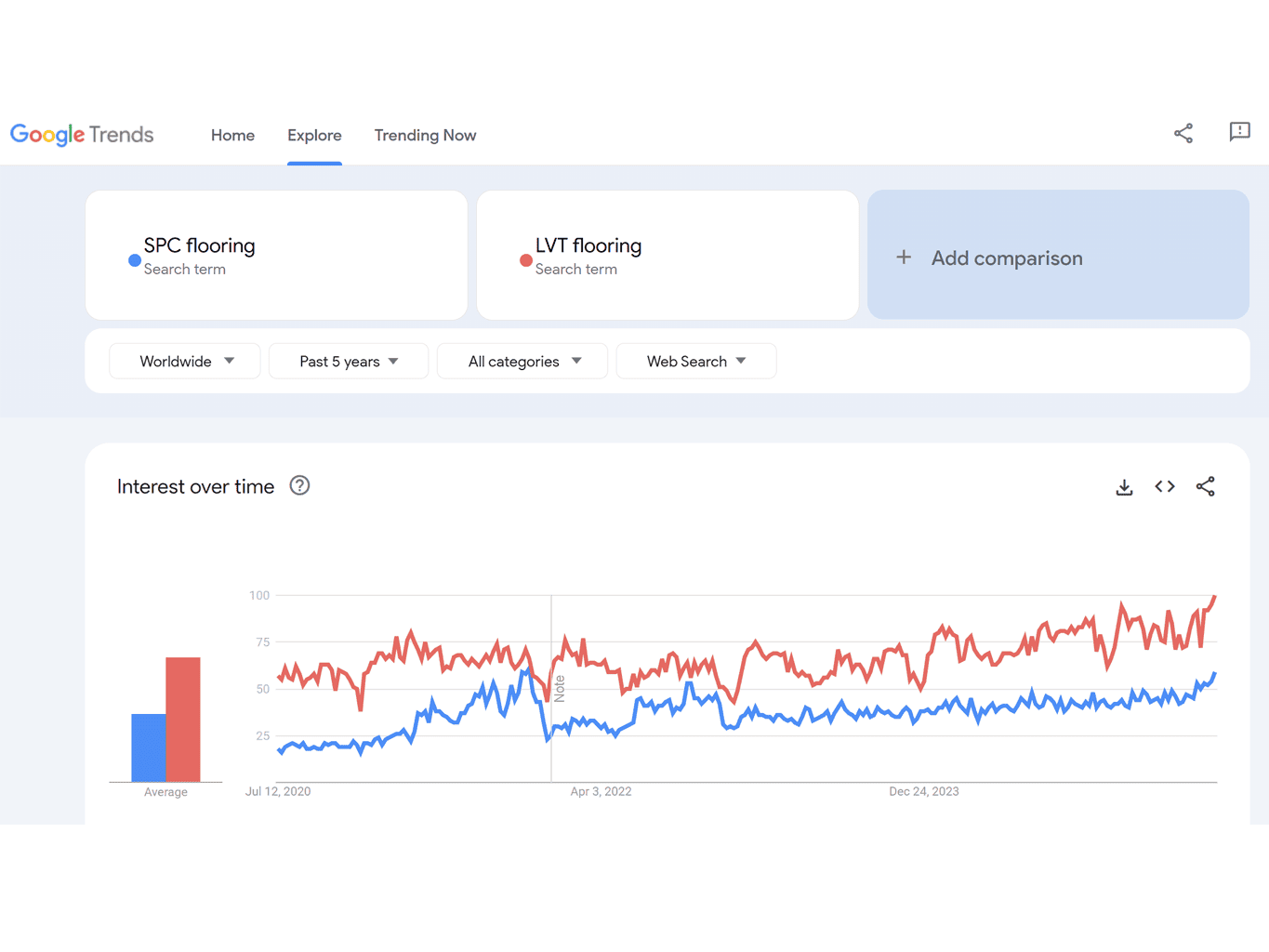

How are the market size and growth forecasts for global SPC and LVT flooring?

Are you sure you know the real potential of the global SPC and LVT flooring market1? If you do not have clear market size and growth forecasts, you might invest in the wrong areas or underestimate the profits you can make. Let us look at these numbers and take the opportunities.

The global SPC and LVT flooring market is expected to keep growing fast in 2025. The global vinyl flooring market (including LVT) is projected to reach $32.9 billion in 2025 and grow to $63.8 billion by 2035, with a Compound Annual Growth Rate (CAGR) of 6.5% (Future Market Insights). The SPC flooring market is expected to grow from $4.5 billion in 2024 to $7.2 billion by 2033, with a CAGR of 6.5% (Market Research Intellect).

The latest reports confirm that the global SPC and LVT flooring market is expanding quickly. It shows strong demand. Future Market Insights projects the global vinyl flooring market (including LVT) to hit $32.9 billion in 2025. It will then grow at a 6.5% Compound Annual Growth Rate (CAGR) to reach $63.8 billion by 2035.

The SPC flooring market also shows good growth. It is expected to go from $4.5 billion in 2024 to $7.2 billion by 2033, with a 6.5% CAGR (Market Research Intellect). Also, Mordor Intelligence predicts the global LVT market will reach $52.86 billion by 2030. It will have a 9.98% CAGR from 2025 to 2030. These strong growth rates show the market has big potential.

This growth is mostly driven by fast urbanization, new building projects worldwide, a boom in home renovations, and consumers preferring durable, waterproof, and affordable flooring solutions. As the head of CloudsFlooring, my team has seen firsthand how these market factors boost demand for our SPC and LVT flooring products. This is because they fit well with these growing market needs.

These numbers show that SPC and LVT flooring are getting more important in the global flooring market. For example, LVT is a top choice for flooring because it is durable, high quality, easy to care for, and affordable. LVT is especially liked for bedrooms, high-end areas, and living rooms in homes. It gives a perfect finish and an elegant look. LVT costs less than carpet and hardwood, which also makes it more attractive.

I see this trend is very clear in North America, the UK, and the Middle East, which are our main export markets. Distributors like Aiden and Lori care about quality and good prices. The features of LVT and SPC are big selling points for them. My CloudsFlooring factory has 3 LVT production lines and 2 SPC production lines. We can make the high-quality, customizable LVT and SPC flooring that these markets need. Understanding these market sizes and growth forecasts helps manufacturers like us and our international distributors adjust their plans to use these booming chances better.

| Market Segment | 2025 Market Size | CAGR | Forecast Target Year | Notes |

|---|---|---|---|---|

| Vinyl Flooring (incl. LVT) | $32.9 billion | 6.5% | 2035 ($63.8 billion) | Residential and commercial demand drive growth (Future Market Insights) |

| SPC Flooring | $4.5 billion (2024) | 6.5% | 2033 ($7.2 billion) | Highly durable, fast growth in commercial applications (Market Research Intellect) |

| Global LVT Market | $32.85 billion | 9.98% | 2030 ($52.86 billion) | Increased demand for high-end designs (Mordor Intelligence) |

How do rapid urbanization and global construction activities drive demand?

Do you sometimes wonder where the global demand for SPC and LVT flooring really comes from? If you do not understand these underlying drivers, you might miss the next big opportunity. We must look at global urbanization and construction activity trends.

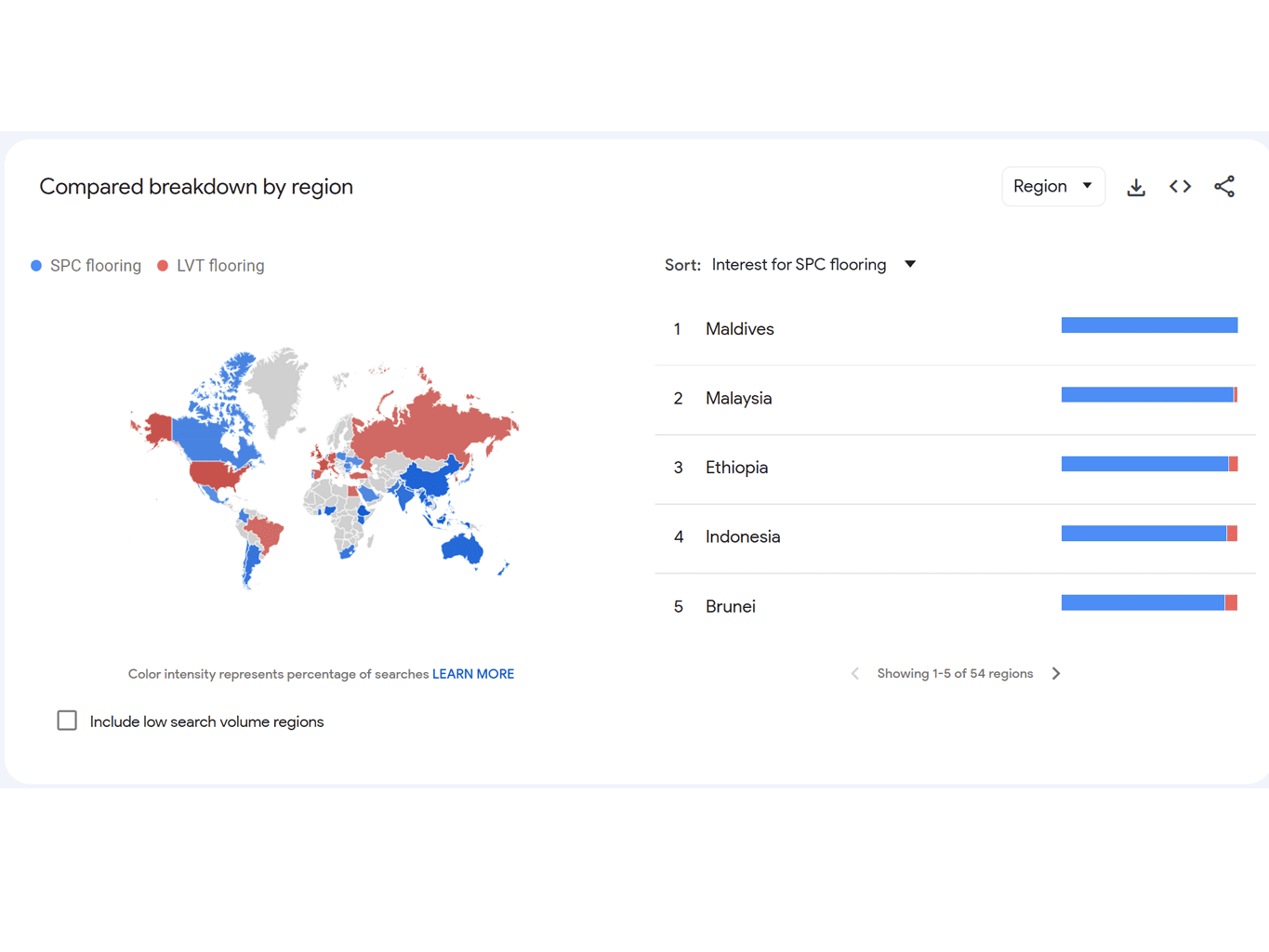

Rapid urbanization worldwide, especially growing construction activity in emerging Asian economies, is strongly pushing demand for SPC and LVT flooring. This creates big market opportunities for international distributors.

The world’s population growth is boosting demand for both residential and non-residential buildings. Developing countries, like China, India, and Southeast Asian nations, have seen big jumps in living standards and home-buying power. This has increased the need for modern floor coverings over the last few decades.

Reports show that the Asia-Pacific region held 65.4% of global flooring market revenue in 2024 (Grand View Research). The China LVT market is expected to reach $2.2 billion in 2025 and grow to $2.97 billion by 2030, with a 6.23% CAGR (Mordor Intelligence). This growth comes from strong demand in commercial spaces like offices, retail stores, and hotels. The commercial flooring market is expected to hit $37.174 billion by 2030, with a 5.9% CAGR.

These are big projects. They need a lot of durable flooring, like LVT and SPC. As a factory, CloudsFlooring has seen this firsthand. We make SPC and LVT, and we know our products fit well in these commercial and residential spaces. My team sees that new infrastructure projects and real estate growth keep creating new chances. This is true for China and for global distributors buying from China. Understanding where these building activities are booming helps distributors like Aiden in the UK or Lori in the US. It helps them target sales better. They know where the end-users are.

Global large-scale urbanization deeply and widely affects the flooring market. It is not just about building new structures; it is also about creating whole city systems. Governments focus on developing second and third-tier cities, beyond big hubs like Shanghai and Shenzhen. This opens new, untouched markets.

These cities are seeing large investments in homes, commercial buildings, and public places like schools and hospitals. Each of these market segments needs specific kinds of flooring. Home projects usually care about comfort and good looks. This leads to demand for vinyl sheets and tiles with real wood or stone finishes.

On the other hand, business spaces need very tough and easy-to-clean options. Our SPC and LVT flooring, for example, can handle a lot of foot traffic. Infrastructure projects need strength and a long life. This ongoing building boom gives flooring makers like us and our international distributors a steady supply of products. We see that these projects ensure constant demand for all types of flooring. This creates a strong market for the foreseeable future.

| Building Type | Primary Flooring Need | Examples of Use | CloudsFlooring Applicability |

|---|---|---|---|

| Commercial Buildings | High durability, easy care | Offices, retail, hotels, hospitals, schools | SPC, Dry back LVT (heavy traffic, commercial grade) |

| Residential Buildings | Aesthetics, comfort, easy install | Apartments, villas, new homes, renovations | Click lock LVT, Self-adhesive LVT (fast install, variety) |

| Public Infrastructure | Extreme durability, safety | Schools, community centers, transport, medical | SPC (tough, waterproof) |

What are the latest technological innovations and product developments in the global SPC and LVT flooring industry?

Are you still relying on old product lines in a fast-changing industry? If you do not keep up with the latest tech innovations, your products might quickly become old. Let me tell you about some new developments that can change the game.

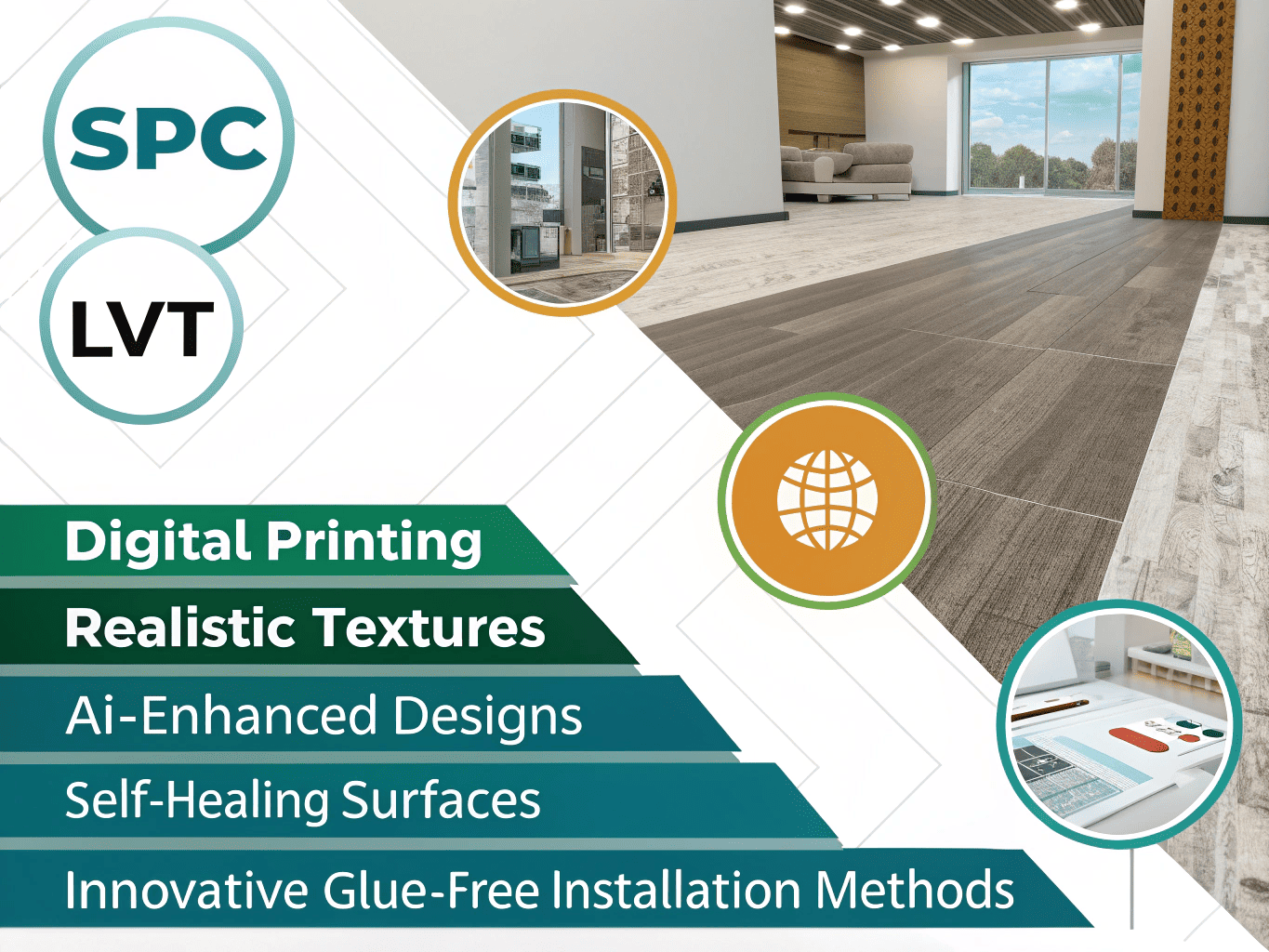

The global SPC and LVT flooring industry is seeing big tech changes. These include advanced digital printing for real textures, AI-enhanced design and self-healing surfaces, and new glue-free installation methods.

Technology is indeed pushing the SPC and LVT flooring industry forward. I see many changes. For example, high-definition digital printing makes flooring look like real wood, stone, and other patterns. Engineered Floors, at its Dalton, Georgia plant, was the first to use Hymmen direct digital printing for SPC flooring. Their PureGrain DLVT product greatly reduced repeat patterns (Floor Trends Magazine). This means LVT and SPC can look very real. You can barely tell them apart from natural materials.

AI-enhanced design and self-healing surfaces also improve flooring durability and looks. For example, Shaw Industries launched eco-friendly vinyl flooring with self-healing surfaces (Future Market Insights). Also, LX Hausys showed TrueFit and TrueQuiet technologies at the 2025 TISE show. These improve flooring performance and user experience (Floor Trends Magazine). Glue-free installation, like peel-and-stick and groutable tiles, is popular with consumers in the home market because it is easy for DIY (Future Market Insights).

We at CloudsFlooring always watch these new things. We aim to offer top quality and unique styles. We make LVT and SPC. We are always looking for ways to make our products better. These new ideas help us offer more unique and high-quality flooring.

Technology progress is changing how SPC and LVT flooring is made, designed, and put in. Digital printing has completely changed how LVT and SPC look good. It allows incredibly realistic copies of natural wood grains, stone patterns, and abstract designs. This means customers can get the look of expensive natural materials without the high cost or upkeep. For us at CloudsFlooring, this lets us offer custom logos and rare styles. Our three LVT and two SPC production lines can quickly adapt to these complex designs.

Besides how it looks, new material science is making flooring stronger, more scratch-proof, and waterproof. This makes our SPC flooring products, for example, tougher. Making advanced click-lock systems has also made installation easier. This saves end-users labor costs and time. This is a big selling point for distributors.

At the same time, some companies are changing how they sell and market to better meet what customers want. For example, COREtec put out a 2025 Style Guide, a flooring buying guide, and regional trend reports. This is to get customers more involved and make the shopping experience better (Floor Trends Magazine). Karndean Designflooring launched the Prana, In CTRL, and Mix & Max collections through their Design Aesthetics program. This meets customer needs for personalized designs (Floor Trends Magazine).

These plans aim to get customers and retailers by offering custom products and insights into regional trends. International distributors must watch these changes. They can give customers different products. This gives them an edge in competition. It helps them meet the changing needs of buyers like Aiden and Lori. They want both quality and unique designs.

| Innovation Type | Impact on SPC/LVT Flooring | Benefits for Distributors/Customers | CloudsFlooring Relevance |

|---|---|---|---|

| Digital Printing | Realistic textures, diverse designs, less pattern repeat | Enhances product appeal, custom options | Customizable logos, rare styles, realistic wood/stone on LVT/SPC |

| AI & Self-Healing Surfaces | Improves durability and aesthetics | Extends product lifespan, less maintenance | (Future tech direction, enhances product performance/appeal) |

| Glue-Free Installation | DIY-friendly, faster installation | Reduces labor costs, quicker project finish | User-friendly installation for LVT/SPC, especially peel-and-stick and groutable tiles |

| New Technologies (e.g., TrueFit, TrueQuiet) | Improves product performance and user experience | Adds product value, meets high-end market needs | (Stays current with industry-leading tech to boost competitiveness) |

What are the sustainability and eco-friendly trends in the global SPC and LVT flooring industry?

Are you aware of the growing demand for eco-friendly flooring1? If your products do not meet environmental standards, you might miss a big part of the market. We must understand these green trends.

Sustainability and environmental concerns are increasingly shaping the global SPC and LVT flooring market. This drives strong consumer and regulatory preference for low VOCs and recyclable materials. It also promotes the development of antimicrobial coating products.

The demand for sustainable and eco-friendly materials is still a strong, long-term trend. Consumers worldwide care more about green products. Regulations also push for healthier, more sustainable options. This means there is a clear preference for flooring with low Volatile Organic Compounds (VOCs). For example, Tarkett S.A. and Forbo Flooring Systems offer low-VOC, recyclable vinyl flooring. This is especially good for healthcare and education areas (Future Market Insights).

People also want materials that can be recycled. Mohawk’s SolidTech R uses 20 recycled plastic bottles per square foot. They plan to keep 6 billion plastic bottles out of landfills each year (Floor Trends Magazine). Also, Mohawk’s PureTech product is 100% PVC-free. It has 70% recycled content and 80% bio-based core content. It meets tough environmental standards (Floor Trends Magazine).

As a factory owner, I understand how important this is. We work hard to make sure our LVT and SPC products meet high quality standards. We also think about how they affect the environment. Distributors should choose manufacturers who offer eco-certified products first. This helps them meet the green needs of the global market. It also makes them a responsible supplier.

The push for sustainability in the SPC and LVT flooring industry is not just a small concern anymore. It has become a big expectation. This is driven by informed consumers and stricter rules. Low VOC emissions are very important. This is because they directly link to indoor air quality and the health of people inside. Products with high VOCs release harmful chemicals that can affect health. This makes a strong demand for flooring that meets international air quality standards.

Recycling is also a main focus. The product’s life cycle, from getting raw materials to disposal, is now checked. This pushes manufacturers to use recycled materials2 and design products that can be recycled. For example, in March 2023, Shaw Industries Group announced they would work with Encina. They will recycle waste from carpet making. This aims to lower greenhouse gases and carbon footprint.

Distributors who want to impress buyers like Lori and Aiden must make sure their supply chain includes manufacturers who put these green features first. Working with factories that invest in eco-friendly ways and certifications is key for long-term success and staying relevant in the market.

Buyers like Aiden and Lori are increasingly aware of these points. Offering certified eco-friendly products can give you a big edge. It shows a promise to quality and global well-being. This trend will not go away. It will only get stronger.

| Environmental Aspect | Importance/Impact | Distributor Action/Benefit | CloudsFlooring Relevance |

|---|---|---|---|

| Low VOC Emissions | Better indoor air quality, occupant health | Meet regulations, attract health-conscious consumers | Focus on quality materials, ensure product safety |

| Recycled Materials | Reduces landfill waste, promotes circular economy | Meets growing demand for eco-friendly products, boosts brand image | Ongoing efforts in sustainable sourcing and production |

| PVC-Free Materials | Reduces environmental footprint, improves product eco-rating | Meets strict environmental standards, attracts high-end green projects | (We continue to explore new eco-friendly materials like Mohawk PureTech) |

| Antimicrobial Coatings | Improves hygiene, especially for healthcare and education | Adds product functionality, meets specific application needs | (Offers SPC/LVT solutions meeting hygiene standards) |

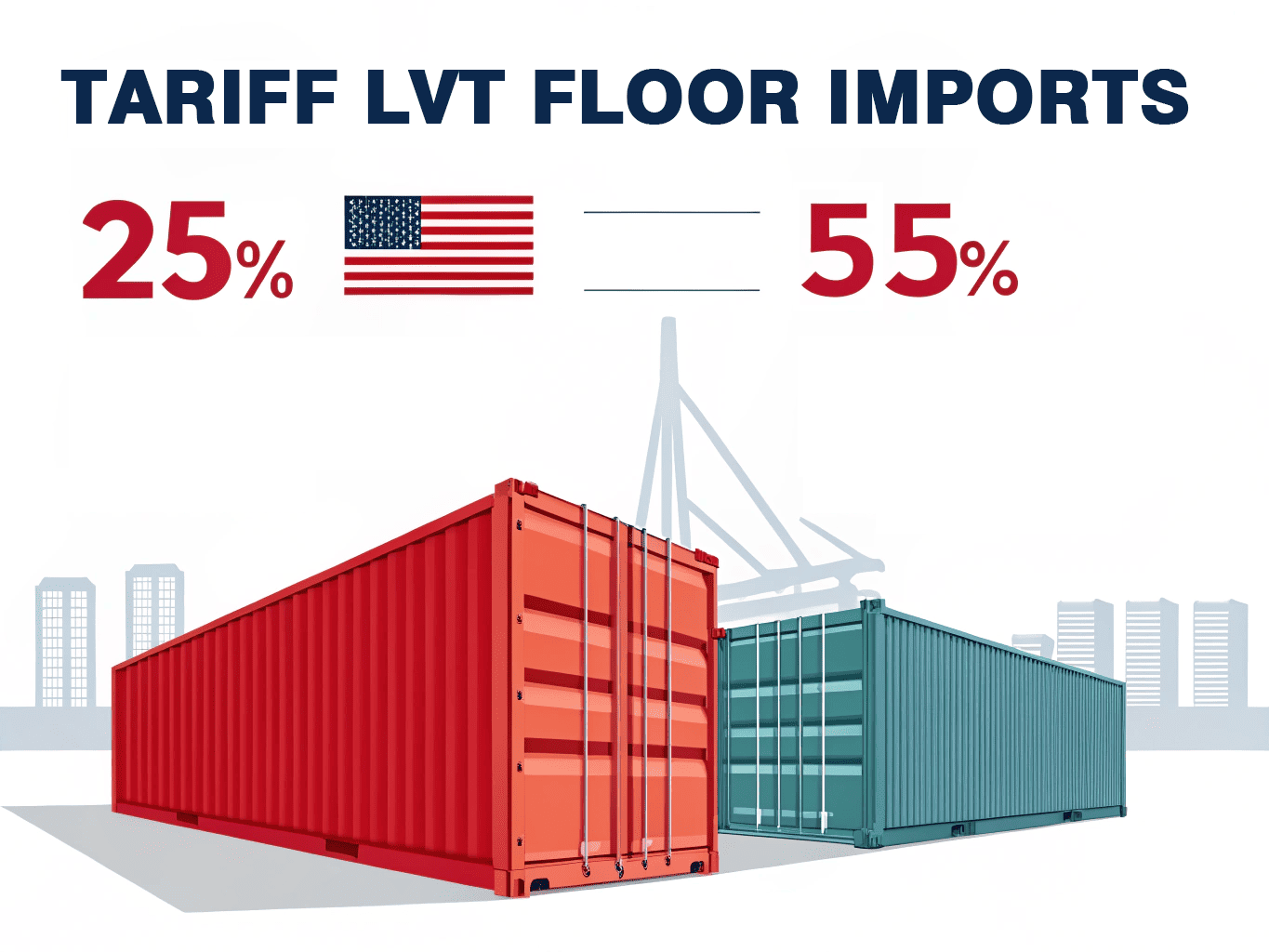

How do international trade dynamics and tariffs affect the global SPC and LVT flooring market?

Are you ready for global trade policy changes that might affect your supply chain? Not knowing about trade dynamics and tariff changes can lead to unexpected costs and delays. Let us see how tariffs shape the market.

US Tariffs on LVT imports from China went up from 25% to 55%. This greatly affects global supply chains. It pushes North American makers to invest more in local production. This helps them rely less on imports and be more competitive (Floor Trends Magazine).

The trade environment in the global SPC and LVT flooring industry is changing a lot. Tariffs are a big part of this change. Tariffs on LVT product imports from China to the North American market have gone up from 25% to 55% (Floor Trends Magazine). This is a big increase. It makes locally made products in North America more competitive.

The higher tariffs led North American manufacturers to make more products themselves. For example, Mohawk Industries plans to invest over $900 million in US production facilities. This includes various flooring types, like SPC and LVT. Shaw Industries also put $90 million into expanding its Ringgold, Georgia plant. They plan to double its capacity by 2026. AHF Products invested nearly $40 million to make more products locally. Engineered Floors added 132 new SKUs in 2025. This improved their hard surface flooring line. These investments might change global supply chains. They could affect pricing and distribution plans.

For international distributors like Aiden in the UK or Lori in the US, this means they need to pay close attention. They need to keep their supply chain stable. They also need to make sure their costs stay competitive.

High tariffs on Chinese LVT products have made big changes in the global flooring supply chain (Floor Trends Magazine). These tariffs aim to protect local industries in importing countries by making foreign products more expensive. For international distributors, this means Chinese LVT flooring costs more to land. This can affect their profit and how competitive their prices are in their local market.

To fix this, distributors are looking at different plans. Some might look for other places to buy from, outside of China. They would look for countries with lower or no tariffs. Others might think about "nearshoring" or even investing in local manufacturing to avoid import tariffs completely. This could mean the distributor’s supply chain gets more complex.

As CloudsFlooring, a B2B wholesale factory with 3 LVT production lines and 2 SPC production lines, we are very aware of these changes. We ship to many countries, including North America, the UK, and the Middle East. We work with our partners to deal with these problems. We make sure our quality stays top-notch no matter how trade changes.

| Tariff Impact | Challenges for Distributors | Distributor Mitigation Strategies | CloudsFlooring Approach |

|---|---|---|---|

| Increased Costs | Higher landed costs, reduced profit margins | Diversify sourcing, negotiate better ex-factory prices | Competitive pricing, focus on value-added features, strengthen customer partnership |

| Supply Chain Disruption | Potential delays, instability due to policy changes | Explore alternative manufacturing regions, watch local production trends | Reliable production, strong logistics support, joint planning with customers |

| Competitive Shift | Local manufacturers gain price advantage | Highlight unique product features, quality, service, offer customization | Top quality, customizable logos, rare styles for differentiation, enhanced service |

| Market Access Changes | Difficulty exporting to high-tariff regions | Target lower-tariff markets, adjust product offerings, partner with local distributors | Focus on UK, Middle East, and other growth markets, explore solutions with North American clients |

What are the key players and strategic shifts in the global SPC and LVT flooring market?

Are you ready to deal with the changing competitive landscape in the global market? Not knowing the main players and their strategic shifts could affect your market position. Let us see how competition shapes the market.

The global SPC and LVT flooring market is moderately to highly concentrated. A few main players hold a big share of the market. Also, industry consolidation, new product innovation, and global expansion strategies keep going.

The global SPC and LVT flooring market1 is very spread out, with several top suppliers operating. However, the industry is seeing consolidation, though slowly. In recent years, the industry has seen many new players. They aim to increase their share in the flooring market through new product ideas, quality, price, service, and technology.

Mergers and acquisitions are common in the industry. This is because players want to grow and make their products more complete. For example, Mohawk Industries bought Elizabeth, a Brazilian company, in November 2022. They also bought Vitromex, a Mexican company, in June 2022. This expanded their production and products in the South American market. AHF Products bought some assets from Armstrong Flooring in July 2022. This included brand names and US manufacturing sites.

These events show that companies in the industry are trying to grow and offer more types of products. They do this through buying other companies and working with partners. Many international players plan to expand globally in the forecast period. This is especially true in fast-growing Asia-Pacific and Latin American countries. My CloudsFlooring team, as a factory with 3 LVT and 2 SPC production lines, watches these market changes closely. This is to make sure our products stay competitive and meet what customers need.

Key players in the global SPC and LVT flooring industry include Mohawk Industries, Inc., Shaw Industries Group, Inc., Tarkett S.A., Armstrong Flooring, Inc., and Forbo Flooring Systems (Future Market Insights). These companies get stronger through new products, wide product lines, and unique technology for flooring.

For example, Mohawk Industries, Inc. holds 15-20% of the global market share.2 They offer high-performance LVT, rigid core, waterproof products, and AI design (Future Market Insights).

Shaw Industries Group, Inc. has 12-16% of the market share. They are known for scratch-resistant, eco-friendly, and self-healing surface products (Future Market Insights). Tarkett S.A. holds 10-14% of the market share. They focus on sustainable, low-VOC, and recyclable flooring (Future Market Insights).

Armstrong Flooring, Inc. (8-12% market share) offers affordable, antimicrobial, and moisture-resistant products (Future Market Insights). Forbo Flooring Systems (5-9% market share) provides sound-reducing, anti-slip products. These are especially good for healthcare and education (Future Market Insights).

These companies not only focus on making new products. They also grow their reach and product lines through buying other companies, expanding, and making joint ventures. This competitive setup makes us keep innovating. It makes sure our LVT and SPC flooring stays ahead in quality, customization, and rare styles. For customers like Aiden and Lori, knowing these main players and their plans helps them choose partners better. It makes sure their supply chain is steady and their products are competitive. We focus on giving top quality and unique styles. This helps our distributors stand out in their markets.

| Company | Market Share (Future Market Insights) | Product Features |

|---|---|---|

| Mohawk Industries, Inc. | 15-20% | High-performance LVT, rigid core, waterproof, AI design |

| Shaw Industries Group, Inc. | 12-16% | Scratch-resistant, eco-friendly, self-healing surfaces |

| Tarkett S.A. | 10-14% | Sustainable, low-VOC, recyclable |

| Armstrong Flooring, Inc. | 8-12% | Economical, antimicrobial, moisture-resistant |

| Forbo Flooring Systems | 5-9% | Sound-reducing, anti-slip, suitable for healthcare and education |

Conclusion

In 2025, the global SPC and LVT flooring market shows strong growth potential. This is driven by new tech, need for sustainability, and changing regional markets. Higher tariffs cause North America to invest more in local production. Asia-Pacific keeps leading the market. International distributors can handle market problems and find growth chances by watching these trends and acting smartly.

The above data is for reference only.