Are you struggling to pinpoint the true cost of imported vinyl flooring? Hidden logistics and duty fees can quickly erode your profits. I will help you uncover these often-overlooked expenses.

Logistics and duties are crucial to your final landed cost, often adding 20-40% or more to the factory price. These include ocean freight, insurance, inland transport, import duties, VAT/GST, and customs brokerage. All of these impact your profit margins significantly.

As a factory owner, I often see importers focus only on the factory price. But that is just one piece of the puzzle. To truly understand your costs and protect your margins, you must dig deeper. You need to know what happens after the goods leave our production lines. Let’s break down these critical components.

How significantly can ocean freight, insurance, and inland transportation add to the initial Factory Price?

Do you only account for the flooring’s factory price? Without considering shipping and insurance, your cost calculations are incomplete. Let’s explore these vital transportation costs.

Ocean freight, insurance, and inland transportation can significantly increase the initial factory price. This can be 10-25% or more, depending on volume, destination, and current market rates. These are non-negotiable costs for getting your vinyl flooring from our factory to your warehouse.

When I talk to clients like Aiden in the UK, they always ask about the FOB price1. But I always tell them that is just the start. The journey from our factory in China to your warehouse involves several distinct logistics layers. Each layer adds to the final cost.

First, ocean freight is the largest variable. Its cost depends on the volume. For example, this means a 20ft or 40ft container. It also depends on the destination port and fluctuating market rates. For example, during peak seasons or global events, container rates can surge unexpectedly. This can turn a profitable deal into a loss if not accounted for. I recall one time when a client had to delay an order. This was because freight costs jumped over 30% in a month. It was tough.

| Ocean Freight Variables | Description | Impact |

|---|---|---|

| Container Size | 20GP, 40GP, 40HQ | Larger containers often offer better per-unit rates. |

| Destination Port | Geographic location, port fees | Costs vary greatly by region and specific port. |

| Market Rates | Supply and demand for shipping | Fluctuates weekly, affected by global events. |

| Peak Season Surcharges | Higher demand periods (e.g., before holidays) | Additional fees during busy shipping times. |

Then, marine insurance is a small but critical fee. It is typically 0.5-1.0% of the total cargo value (Cost, Insurance, Freight – CIF). It protects against loss or damage during transit. It is an easy cost to forget. However, a broken container of flooring is a big problem without it.

Finally, inland transportation covers getting the container from the destination port to your warehouse. This cost varies greatly by country and distance from the port. For Aiden, this might mean trucking from Southampton to his warehouse. For Lori in the US, it could be from Long Beach to somewhere in the Midwest. These fees include trucking, drayage, and often, port congestion surcharges. Missing any of these steps in your budget is a common mistake.

| Inland Transportation Fees | Description |

|---|---|

| Trucking Rates | Cost for road transport from port to warehouse. |

| Drayage Fees | Fees for moving the container within the port terminal. |

| Fuel Surcharges | Additional fees based on fuel price fluctuations. |

| Port Congestion Fees | Charges due to delays at congested ports. |

| Logistics Component | Description | Impact on Cost |

|---|---|---|

| Ocean Freight | Shipping containers across the ocean | Highest variable cost |

| Marine Insurance | Coverage for goods during transit | Small percentage (0.5-1.0% CIF) |

| Inland Transport | From destination port to final warehouse | Varies by distance and country |

What import duties, taxes (VAT/GST), and customs brokerage fees must be factored into the landed cost beyond the Factory Price?

Are you overlooking crucial government charges on your imports? Unexpected duties and taxes can significantly inflate your product costs. Let’s demystify these essential import fees.

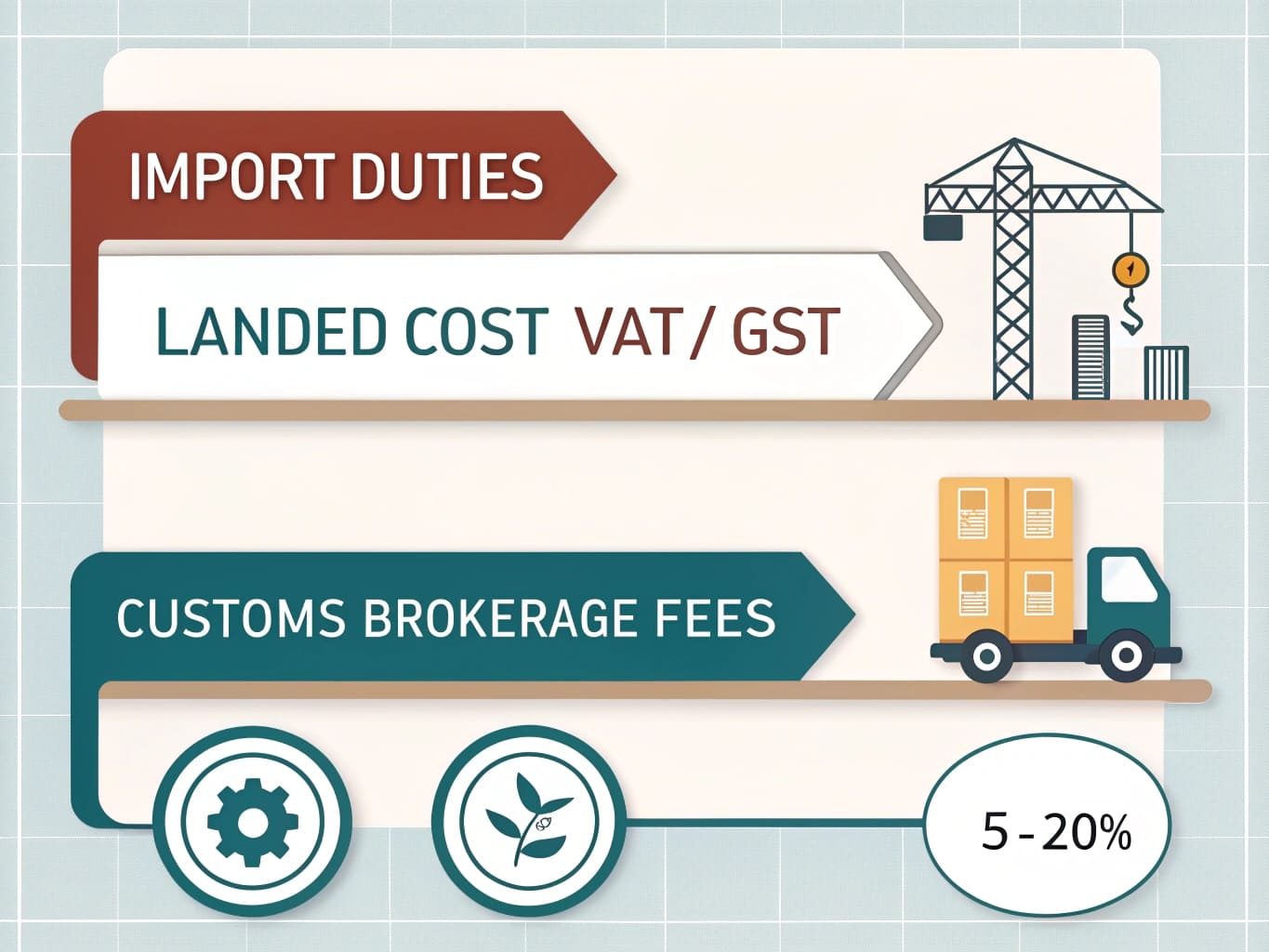

Beyond the factory price, importers must factor in import duties, taxes like VAT/GST, and customs brokerage fees. These governmental and service charges can add another 5-20% (or more, depending on tariffs) to your landed cost. This makes them vital for accurate profit calculations and compliance.

I have learned that many new importers, especially those from the UK or North America, sometimes underestimate the impact of duties and taxes. They often assume it is just a small percentage. However, these can be substantial.

First, import duties2, also known as tariffs, are taxes imposed by the importing country. These taxes are on goods entering its customs territory. The rate depends entirely on the product type. The HS Code for vinyl flooring is key here. It also depends on the country of origin. For example, some countries might have anti-dumping duties on certain types of flooring. This can add a significant percentage. This is where my conversations with clients like Aiden and Lori become critical. We need to ensure the correct HS code is used to avoid issues at customs.

| Duty-Related Factors | Description | Importance |

|---|---|---|

| HS Code (Harmonized System) | International product classification code. | Determines the exact duty rate. |

| Country of Origin | Where the product was manufactured. | Affects duty rates due to trade agreements or tariffs. |

| Anti-dumping Duties | Extra duties on certain goods priced below fair value. | Can significantly increase the cost for specific products. |

Then there are consumption taxes, like VAT (Value Added Tax) in the UK or GST (Goods and Services Tax) in other regions. These are typically applied to the CIF value plus duties. While often recoverable for businesses, they still represent an upfront cash outlay. This affects cash flow. I have seen clients forget this initial payment. This leads to budget shortfalls.

Lastly, customs brokerage fees are paid to agents. These agents navigate the complex customs clearance process. They prepare documents, calculate duties, and ensure compliance. While typically a fixed fee or a small percentage of the cargo value, choosing an efficient broker is crucial. This helps avoid delays and demurrage charges. These charges can add up fast if your goods sit at the port due to paperwork issues. I always advise my clients to find a reliable local broker.

| Customs Brokerage Services | Description | Common Fee Structure |

|---|---|---|

| Documentation Preparation | Filling out entry forms, declarations. | Included in a flat fee. |

| Duty Calculation | Verifying HS codes and calculating duties. | Included in a flat fee. |

| Customs Clearance | Liaising with customs authorities. | Flat fee per shipment. |

| Disbursement Fee | Handling payment of duties/taxes on your behalf. | Small percentage of duties paid or flat fee. |

| Import Charges | Description | Calculation Basis |

|---|---|---|

| Import Duties (Tariffs) | Tax on imported goods | HS Code, Country of Origin, Trade Agreements |

| VAT/GST | Consumption tax | CIF Value + Duties |

| Customs Brokerage Fees | Services for customs clearance | Per shipment, percentage of cargo value |

Why is accurately calculating the full landed cost essential for determining true product profitability?

Are your profit margins shrinking unexpectedly? Ignoring the full landed cost3 masks your true product profitability. Discover why precise calculations are non-negotiable for success.

Accurately calculating the full landed cost is essential. It reveals the true cost of bringing a product to your warehouse. This encompasses factory price, logistics, and duties. This holistic view ensures correct pricing, prevents profit erosion, and enables informed business decisions. It protects your bottom line.

From my perspective as a factory owner, I understand that my clients, like Aiden and Lori, need to make money. They buy from me, rebrand, and sell at a higher price. But if they do not know their true cost, their profit model breaks down. I always tell them, "The factory price is only the beginning!"

First, accurate landed cost helps you set competitive and profitable selling prices. Without it, you might underprice and lose money on every sale. Or you might overprice and lose sales to competitors. I remember a time a client quoted a project based only on our FOB price. Then they realized too late that the specific destination in the US had high inland freight costs. This turned their profit into a loss.

Second, understanding the full landed cost allows for better budget planning and cash flow management. Knowing exactly how much money is tied up in each shipment, from production to delivery, prevents nasty surprises. My clients often deal with large volumes. Even a small miscalculation per square meter can become a huge problem across thousands of square meters.

Third, it aids in strategic sourcing decisions. When you compare suppliers, you cannot just compare factory prices. You need to compare their total landed cost from various origins. Maybe a slightly higher factory price from one supplier offers a lower overall landed cost. This could be due to better logistics options or trade agreements. This holistic view helps Aiden and Lori make smarter choices about where to source their LVT or SPC flooring.

Finally, accurate landed cost calculation helps identify cost-saving opportunities. Perhaps optimizing container loading, negotiating better inland freight rates, or exploring alternative ports could shave off a few cents per square meter. Over time, these savings add up to significant profit increases.

| Common Pitfalls of Inaccurate Landed Cost | Consequence |

|---|---|

| Underpricing Products | Leads to lower profit margins or even losses per sale. |

| Budget Overruns | Unexpected expenses cause cash flow shortages. |

| Poor Sourcing Decisions | Choosing suppliers based on incomplete cost data. |

| Lost Sales | Overpricing products due to inflated cost assumptions. |

| Operational Inefficiencies | Missed opportunities to optimize supply chain costs. |

| Benefit | Description | Why it matters |

|---|---|---|

| Accurate Pricing | Set competitive and profitable selling prices for your vinyl flooring. | Prevents underpricing (loss) or overpricing (lost sales). |

| Budget Planning | Forecast cash flow and allocate funds correctly for imports. | Avoids unexpected expenses and budget shortfalls. |

| Strategic Sourcing | Compare suppliers based on total landed cost, not just factory price. | Ensures you choose the most cost-effective overall solution. |

| Profit Protection | Identify hidden costs and areas for cost reduction. | Safeguards your profit margins and enhances business viability. |

Conclusion

Calculating the full landed cost for vinyl flooring is critical. It encompasses factory price, logistics, and duties, ensuring you know your true expenses. This detailed understanding protects your profits and enables smarter business decisions.

The above data is for reference only.

-

Understanding FOB price is crucial for importers to grasp initial costs before additional logistics expenses. ↩

-

Exploring import duties helps you understand additional costs that can impact your overall profitability. ↩

-

Learning about landed cost is essential for accurate pricing and profit margin protection in international trade. ↩